Dubai residents planning to travel to the Philippines will soon have more flight options, as Emirates has announced the addition of four more weekly flights between Dubai and Manila, effective April 2.

The additional services will operate on Mondays, Wednesdays, Thursdays and Saturdays, increasing Emirates’ total frequency on the route.

Flight EK330 will depart Dubai at 12.45pm and arrive in Manila at 1.25am the following day. The return service, EK331, will depart Manila at 3.25am and arrive in Dubai at 8.25am. All timings are local.

Better global connectivity

The expanded schedule will provide shorter and more convenient connections to and from Canada and the United States, as well as late-morning departures to major European cities including London, Milan, Budapest and Athens, via Dubai.

Emirates launched services to Manila in 1990 and has steadily expanded its footprint in the Philippines, including circular services to Cebu and Clark. The airline currently operates 28 weekly flights to the country, a number that will rise to 34 weekly services following the launch of the new flights.

Strengthening UAE–Philippines ties

The expansion comes shortly after the UAE and the Philippines signed a Comprehensive Economic Partnership Agreement (Cepa), aimed at boosting trade, investment and economic cooperation. Emirates’ growing presence in Manila and Cebu/Clark positions the airline to support increasing passenger and cargo demand between the two countries.

Aircraft and onboard experience

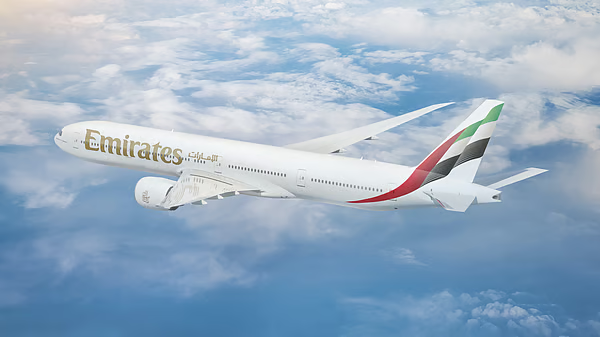

The additional flights will be operated using Emirates’ Boeing 777-300ER, featuring:

- 8 private First Class suites

- 42 lie-flat Business Class seats

- 304 Economy Class seats

Passengers will continue to enjoy Emirates’ signature service, including regionally inspired meals, complimentary beverages and the airline’s ice inflight entertainment system, which offers more than 6,500 on-demand channels in over 40 languages, including Tagalog.

Cargo capacity boost

In addition to passenger services, the Boeing 777-300ER can carry up to 20 tonnes of cargo per flight. The four additional weekly services will significantly enhance cargo capacity between Dubai and Manila, supporting trade flows with key markets across Europe, the US and the Indian subcontinent.

Tickets for the new services are available via the Emirates website, mobile app, travel agents and Emirates retail stores.